If you pay annually and also have no installment or other charges, you divide your annual costs by 12. (Annual premium-discount)/ 12 months = monthly price, Your monthly auto insurance policy cost, if paying in full in advance, would certainly be $91.

Among the largest elements for consumers looking to buy auto insurance policy is the price. Not just do costs vary from business to business, yet insurance policy expenses from state to state vary also. According to , the typical annual cost of auto insurance coverage in the USA was $1,633 in 2021 and also is projected to be $1,706 in 2022.

Typical rates vary commonly from state to state. Insurance coverage prices are based upon numerous criteria, including age, driving history, credit report, the amount of miles you drive per year, vehicle type, and more. Counting on typical auto insurance policy costs to approximate your automobile insurance costs may not be one of the most precise method to find out what you'll pay. automobile.

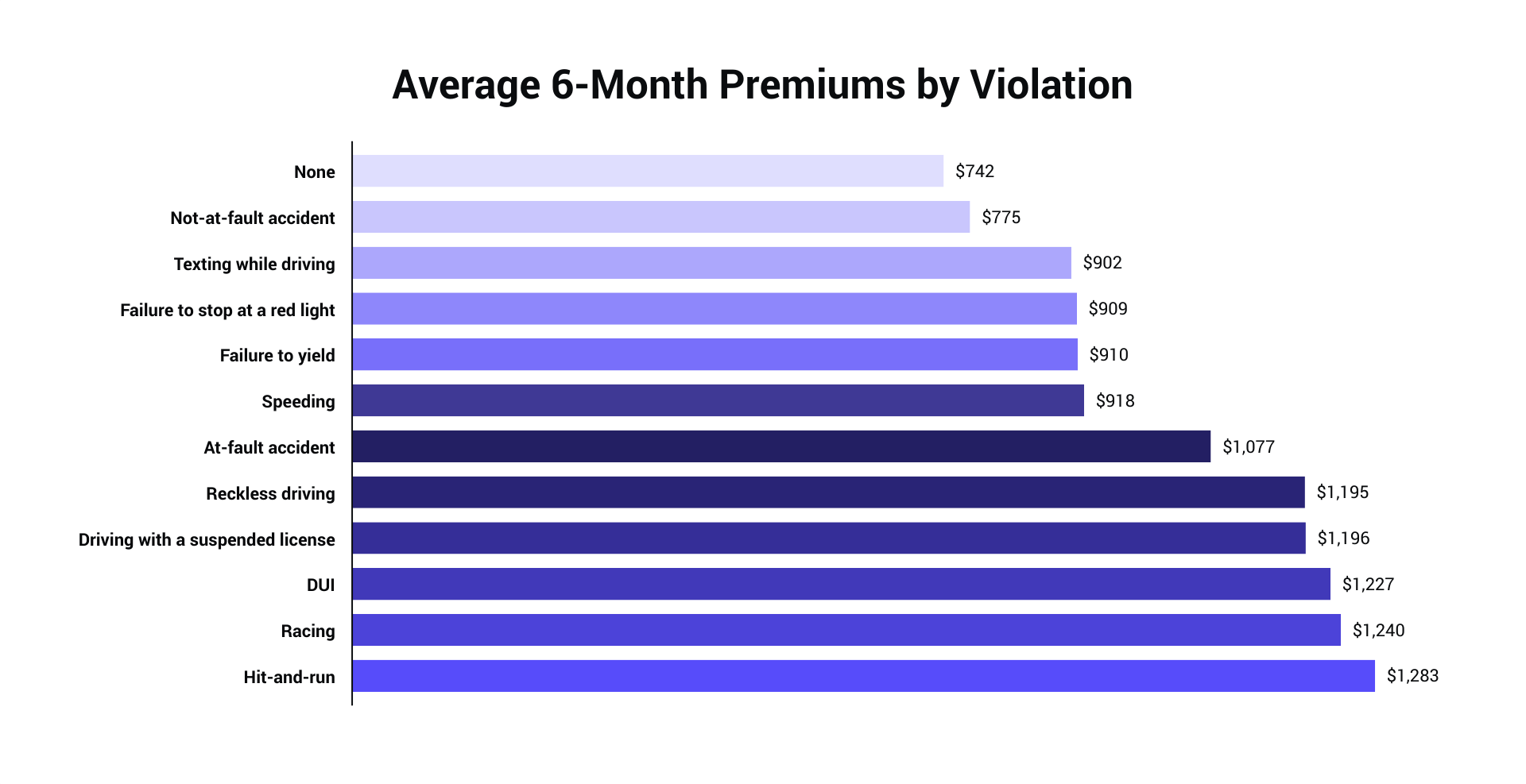

Insurers use numerous variables to establish rates, as well as you might pay even more or much less than the typical driver for coverage based upon your risk profile. More youthful chauffeurs are normally extra most likely to get into a crash, so their costs are typically greater than standard. You'll also pay even more if you have an at-fault crash, numerous speeding tickets, or a DUI on your driving document.

It might not provide sufficient defense if you're in a mishap or your automobile is damaged by one more covered case. Curious concerning just how the average price for minimum insurance coverage piles up against the expense of complete insurance coverage?

Some Known Factual Statements About Annual Vs Monthly Car Insurance - Moneysupermarket

The only method to know exactly just how much you'll pay is to go shopping about and get quotes from insurers. And considering that insurance laws as well as minimum protection requirements differ from state to state, states with greater minimum needs usually have higher typical insurance costs.

The majority of yet not all states allow insurance policy companies to utilize credit report ratings when establishing prices - auto. Generally, applicants with lower ratings are more probable to sue, so they generally pay much more for insurance than drivers with higher credit history ratings - vehicle. If your driving record consists of accidents, speeding tickets, DUIs, or various other infractions, anticipate to pay a greater costs.

Cars with greater price tags generally set you back more to guarantee. Motorists under the age of 25 pay greater rates as a result of their absence of experience and enhanced mishap threat. Men under the age of 25 are normally quoted greater rates than ladies of the same age. Yet the void shrinks as they age, and women might pay a little much more as they age.

vehicle insurance insurance automobile cheapest auto insurance

vehicle insurance insurance automobile cheapest auto insurance

Since insurance coverage firms tend to pay even more claims in high-risk locations, rates are generally higher. Getting married usually results in lower insurance policy premiums. Obtaining appropriate coverage might not be inexpensive, yet there are ways to obtain a discount on your car insurance policy. Below are 5 common discount rates you may receive.

If you possess your home rather than renting it, some insurers will give you a discount on your auto insurance policy premium, also if your home is insured through one more business. insurance. Apart From New Hampshire as well as Virginia, every state in the country needs vehicle drivers to preserve a minimum amount of obligation protection to drive legally (insure).

Little Known Questions About Average Car Insurance Cost (May 2022) - Wallethub.

It Check out here may be tempting to stick with the minimum restrictions your state needs to save on your costs, however you could be placing on your own in jeopardy - cheap insurance. State minimums are infamously reduced as well as might leave you without sufficient security if you remain in a serious accident (suvs). The majority of professionals advise keeping enough protection to shield your assets.

Sirijit Jongcharoenkulchai/ Eye, Em, Getty Images Just how much you should pay for car insurance coverage varies widely based upon a variety of aspects. Geography is normally the most vital element for safe chauffeurs with decent credit, so it helps to comprehend your state's standards (money). The nationwide average for cars and truck insurance policy premiums is concerning $1621 each year, and there are states with standards much away from that figure in both directions.

vehicle insurance dui affordable car insurance low-cost auto insurance

vehicle insurance dui affordable car insurance low-cost auto insurance

:max_bytes(150000):strip_icc()/how-much-does-car-insurance-cost-5072100_final-915c31d331c9435085f258da3e1e1852.png) dui vehicle cars affordable auto insurance

dui vehicle cars affordable auto insurance

Average National Prices, The overall national typical cost of car insurance will vary based on the resource - vehicle. Whatever the instance might be, you'll most likely discover on your own paying even more than $100 per month for automobile insurance policy (car).

When computing national expenses, a variety of factors are consisted of. A number of coverage choices are readily available from insurance business, as well as the typical number needs to reflect the most common kind of protection. In this situation, the nationwide cost numbers determine policies that include obligation, thorough, and also accident insurance coverage in addition to state-mandated insurance policy like accident security as well as without insurance vehicle driver coverage.

Generally, the minimum insurance coverage will set you back concerning $676 per year, which is nearly $1000 much less than the national average annually (insurance). While these averages can be valuable for getting a suggestion of what insurance expenses, your personal factors have the a lot of effect on the premium prices you'll obtain. Average Protection Level, Normally, people have a tendency to choose even more protection than the minimum that's legitimately needed.

Unknown Facts About Average Cost Of Car Insurance (2022) - Valuepenguin

On average, complete insurance coverage will cost not also $900 per year - prices. North Carolina and also Idaho are likewise remarkable for offering budget friendly complete insurance coverage. One of the most pricey state for insurance policy is Michigan, and its average costs are far beyond the nationwide standard. For complete coverage in Michigan, you'll be paying over $4000 per year, though there are efforts to reduce this price.

Variables Affecting Your Premiums, Just how much you must be paying for your premiums is largely impacted by differing personal aspects in enhancement to your details location. auto. While any variable can suggest how much of a threat you will certainly be to guarantee as a motorist, the most vital variables are generally the very same throughout all insurance coverage companies, though there are exemptions (cheaper car).

Minimum state-required insurance coverage will constantly be one of the most cost effective, yet if you intend on offering your auto at a later date, comprehensive coverage may be a personal necessity. Age: Age plays a huge function in just how much your premium is. If you're over the age of 25 with a tidy history, your premiums will largely be the exact same for decades.

Teenagers are especially pricey to cover, as they posture one of the most take the chance of as a result of their lack of experience. Time when driving: The more time you invest on the road, the greater your premiums are mosting likely to be. This results from the large chance of entering a mishap being increased contrasted to people that don't drive as much (laws).

This is just real if you go with extensive and accident insurance. Given that a lot of people intend to sell higher-end designs in the future, nonetheless, comprehensive and also collision insurance policy might be a requirement - affordable. Credit history rating: Your credit rating shows how trusted you are when it comes to paying back financings.

Not known Factual Statements About Average Cost Of Car Insurance (2022) - Valuepenguin

insurance affordable insurance affordable liability cheaper cars

insurance affordable insurance affordable liability cheaper cars

Exactly how a lot you should pay for vehicle insurance depends on several aspects all functioning with each other. Because of this, there is no one-size-fits-all answer to your car insurance coverage requires.

insured car vehicle insurance vans vans

insured car vehicle insurance vans vans

You might be able to find more info concerning this and also comparable content at.